Putin Shot Himself in the Foot: Will Russia Have Enough Money for the War from Oil and Gas?

Russia’s war against Ukraine and Europe is largely associated with natural gas, although it is the export of oil and oil products that generates the greatest revenue for the terrorist state. Before the full-scale invasion on 24 February, every fourth barrel of crude oil imported in the EU arrived from Russia. Sale of oil and oil products to the world market in 2021 brought Russia 3.2 times more revenue than gas sales. The EU also accounted for the largest volumes of shipments.

On 5 December, a ban on the import of Russian oil delivered by sea came into force, and on 5 February 2023, a restriction on the import of Russian oil products will become effective. This is the first vector of oil sanctions. The second vector is a ban on providing maritime services for the transportation of Russian oil and ensuring such cargo if its price exceeds a certain price cap — 60 dollars per barrel. In 2023, we will see exactly how the oil embargo will work but it is already obvious that such a price cap is too high and will preserve opportunities to fuel the war at the expense of petrodollars. Prime price of oil production in the Russian Federation varies from 15 to 45 dollars, depending on the depth, geography, and mining conditions. Excessively high price cap for Russian oil preserves a sufficient amount of tax liabilities for the federal budget — the war budget. This will not stop Russian aggression. The price cap must evolve to the level of 20–30 dollars per barrel.

Although OPEC+, a cartel of oil exporters together with Russia, tried to keep high oil prices in the markets through production quotas at the end of 2022, the release of additional volumes of oil from the US strategic oil reserves together with the policy of setting a price limit for Russian oil by the G7 countries in December, helped lower oil prices in the global market.

Industrial production of oil and oil products has been going on for about 160 years, and during that time, various configurations of the club of oil-producing states were formed but the club of oil buyers was never created. Today, we are de facto witnessing the emergence of ‘anti-OPEC’ – a cartel of oil buyers to oppose the cartel of oil-producing states, for the first time in history. In 2023, we will see its clearer outlines, but this will depend on the success of the current sanctions policy against Russian oil and oil products. The events taking place now are very similar to the events of the early 1970s before the Arab oil embargo when a group of producing countries was consolidating for a price strike against the West.

In times of turbulence, it is difficult to make forecasts, but some oil exporters, in particular, Algeria and the Russian Federation, when preparing their budgets, set an average estimated price for oil at the level of 70 dollars per barrel in 2023. Specialists of the US Energy Information Administration forecast the average price of Brent oil in 2023 at the level of 92 dollars per barrel, and on 1 December 2022, a pool of 38 Reuters economists predicted an average price of 100.5 dollars per barrel in 2023.

Recessions in the EU and the US and covid restrictions and lockdowns in China, the world's largest oil consumer, signal that oil demand will be moderate in 2023 at the earliest but prices will creep back up if China’s economic recovery is faster than expected. In November 2022, Goldman Sachs economists predicted: if there is a sharp wrapping of the policy of zero tolerance to covid by China, then oil prices may jump to 125 dollars per barrel.

With the introduction of the embargo on Russian oil products in February 2023, a reorientation to oil products from the Persian Gulf and the US will take place in Europe, which will require the construction of new supply chains, which may result in an increase in the prices for oil products, in particular, for diesel.

Putin’s decree dated 27 December in response to the introduction of the price cap appears as a demonstrative shot in his foot that does not change anything. According to the decree, a ban on selling oil to all countries that have joined the oil embargo, that is, that have already voluntarily given up this oil, is introduced.

Russia’s role as a supplier of oil and oil products in the EU market is changing, and how drastic these changes will be will depend on the political will of the EU countries and the US to adhere to the oil embargo. The price cap is due to be reviewed every two months, and the embargo situation is subject to change, and Russia is already trying to test the strength of the EU sanctions policy by sending oil tankers to Greece.

European gas market

After the Russian invasion of Ukraine, the EU adopted a number of successive decisions on the replacement of Russian energy carriers. Thus, recently, the European Parliament in the Resolution dated 6 October 2022, repeated its call for an immediate and total embargo on the import of fossil fuels and uranium from the Russian Federation. And in the next resolution, it supported an unprecedented package of 18 billion euros for Ukraine in 2023 to ensure macroeconomic stability and restore the Ukrainian energy infrastructure. The importance of quick provision of financial and technical assistance was emphasized in view of the approaching winter when a significant number of Ukrainian citizens risk losing access to essential services: water, heating, and electricity.

It is safe to say that the urgent task of 2023 will be to intensify activities in Europe to protect critical energy infrastructure, including offshore gas pipelines, submarine cables, and energy infrastructure of seaports. These activities should be considered as priority to enhance resilience against possible external attacks. It is especially significant to increase the resilience of Ukraine, the EU, and NATO Member States and partners against attacks by an ‘unidentified party’ in the Baltic and Black Sea regions.

The replacement of the Russian gas supplier requires urgent actions in the sphere of its import to the European Union. The status of Ukraine as the EU candidate significantly strengthens the potential of energy cooperation and opens up new opportunities that should effectively be used in 2023. The fact is that both Ukraine and most of the EU countries currently have a consolidated position: Russian gas should be removed from the European market. And if Ukraine has not imported a single cubic meter of gas from Gazprom since November 25, 2015, the EU countries are moving towards this only now.

European experts emphasize that the gas market is in a very difficult situation. This is how one of the employees of the European Commission’s Directorate-General for Energy (DG ENERGY) has recently described the situation. “We have made progress with some of the tools that have been launched this year, but it will still be difficult in 2023 and beyond. We are well prepared for this winter through gas supply efforts, high storage levels, and measures to reduce demand.”

To improve gas supplies to the European market, the EU Energy Platform was created and is starting to work. It will play a key role in shaping the overall demand for gas, coordinating the use of infrastructure, negotiating with international partners, and preparing joint purchases of natural gas and hydrogen. It is a voluntary coordination mechanism that ensures cooperation in areas where it is more effective to act at the EU level rather than at the national level. With the help of the Energy Platform, EU countries can unite to ensure affordable energy supply from reliable partners.

The energy platform contains a mechanism for taking Ukraine’s interests into account. In particular, the governing council of the platform consists of representatives of the European Commission, all EU Member States, as well as representatives of the contracting parties of the Energy Community for the oversight of the process of security of supply, transparency, and solidarity. The Energy Platform is assumed to use for security of supply the existing structures: the Gas Coordination Group (GCG), the Network of Transmission System Operators for Gas (ENTSO-G) and will act through regional groups. The Central East Regional Group (CERG) works in coordination with EU countries concerned and neighboring Energy Community contracting parties, including Ukraine and Moldova. Key issues of regional cooperation in the field of gas demand, potential for demand reduction, effective use of gas infrastructure, and gas supply options for diversification, are being discussed.

It is extremely important to create a joint procurement mechanism within the platform with an appropriate IT tool to match the aggregate demand for gas with the most competitive supply offers. It has already been clearly determined that Russian sources of supply will be excluded from participation in the Energy Platform.

In 2023, we will become witnesses to fierce disputes in the EU concerning the (im)possibility of Russia’s gas embargo, Kremlin’s next attempts to act with the ‘carrot’ (by temptation of cheap gas under direct contracts) and ‘stick’ (by limiting of shipments and covert actions against gas infrastructure) with regard to the EU and its Member States, the start of Türkiye’s exploitation of gas fields in the Black Sea, and another attempt to implement the Trans-Caspian Gas Pipeline project carrying gas from Turkmenistan to Europe.

Atomic energy

On 1 January 2023, the Taxonomy Complementary Climate Delegated Act entered into force; it will foster the attraction of private investments in nuclear energy and accelerate the preparation of nuclear reactor projects in at least seven EU member states. The share of nuclear generation will remain at the level of 2022 and will be about 25% of the total production in the EU, provided that Germany prolongs service life of its three nuclear power plants which are currently scheduled to be closed in April 2023. New capacities may appear in Slovakia, the third and fourth units of the ‘Mochovce’ NPP. The key challenges are to overcome dependence on Russian nuclear fuel and to store the spent fuel.

Ukrainian NPPs will remain the main producers of electricity for the needs of the domestic economy and households where the latter will continue to be supported due to the assigned special duties which will make it possible to maintain regulated prices with minimal changes. The main challenge will be to return control over the Zaporizhzhia NPP and guarantee its safe operation as well as to prevent seizure or sabotage of the Rivne NPP. Provided the military campaign is successful, air defenses are strengthened, and the destroyed transmission infrastructure is restored, it is likely that electricity exports to neighboring EU countries will be resumed to obtain foreign exchange earnings, increase the investment in reconstruction, and launch new projects within the framework of the agreements signed with Westinghouse and Holtec on the development of nuclear energy in Ukraine.

Green energy

The RePowerEU Initiative, together with high prices and the threat of energy shortages, have significantly boosted the pace of the introduction of renewable energy sources in the EU. According to preliminary estimates, total aggregated heat capacity may reach 50 GW in 2022, with a steady trend to maintain growth in 2023, primarily among households. The European Commission's initiation of additional measures to simplify licensing procedures has the potential to launch mass implementation of new projects already in the coming years. At the same time, on the path of intensive development of renewable energy, relations with authoritarian China are becoming increasingly problematic, which threatens war in the Pacific region of Taiwan and is the main supplier of both a significant amount of equipment for renewable energy sources (RES) and critical raw materials for the EU.

In Ukraine, almost half of the 9.5 GW of installed renewable energy facilities at the beginning of 2022 remains in the zones of active hostilities, which makes their return to the power system in the course of 2023 unlikely. Only small distributed generation, primarily power plants at the household level as autonomous backup sources of generation, will retain development prospects. By the end of 2023, we can expect the development and approval of the legal framework for opening the export of renewable energy to EU Member States.

Energy sanctions

In 2023, work on strengthening the sanctions regime against the Russian Federation in the field of energy will continue. However, the sanctions regime will be significantly more effective under the condition of strict monitoring and control. To strengthen the regime, current international actions, and contacts with third countries, the position of a special envoy for the implementation of sanctions was introduced in the EU. Experienced EU diplomat David O'Sullivan will officially take up the role in the second half of January 2023.

This is important taking into account reports on violations of the sanctions regime. In particular, the attempts to violate the EU embargo on maritime imports of crude oil from the Russian Federation, which were committed by three Greek tankers on 23-24 December. This attempt was reported by the Monitoring Group of the Black Sea Institute of Strategic Studies. It is also necessary to extend the sanctions regime to the enterprises of the Russian energy industry, which are directly related to the ability to wage an aggressive war and the participation of many Western companies in them. Not all of them are included in the sanctions lists.

Therefore, prevention of the circumvention of sanctions restrictions, monitoring and strict control over the implementation of the sanctions regime in the energy sector are vital tasks for the next year. Ultimately, the unspoken taboo on sanctions against Rosatom, which has become an instrument of the Kremlin's nuclear arbitrariness, blackmail, and terror, must be lifted.

The EU and G7 sanctions against Russia aim to paralyze its ability to wage war against Ukraine. Currently, such actions of the West continue to be an instrument of forcing the Kremlin to peace. According to an internal report of the European Commission, economic restrictions, the most troublesome of which concern the energy sector, significantly weaken the ability of the Russian regime to fight against Ukraine. However, EU actions do not stop Russia, because they are selective. Sanctions against a country that unleashed aggression in Europe and is creating nuclear threats must not be selective.

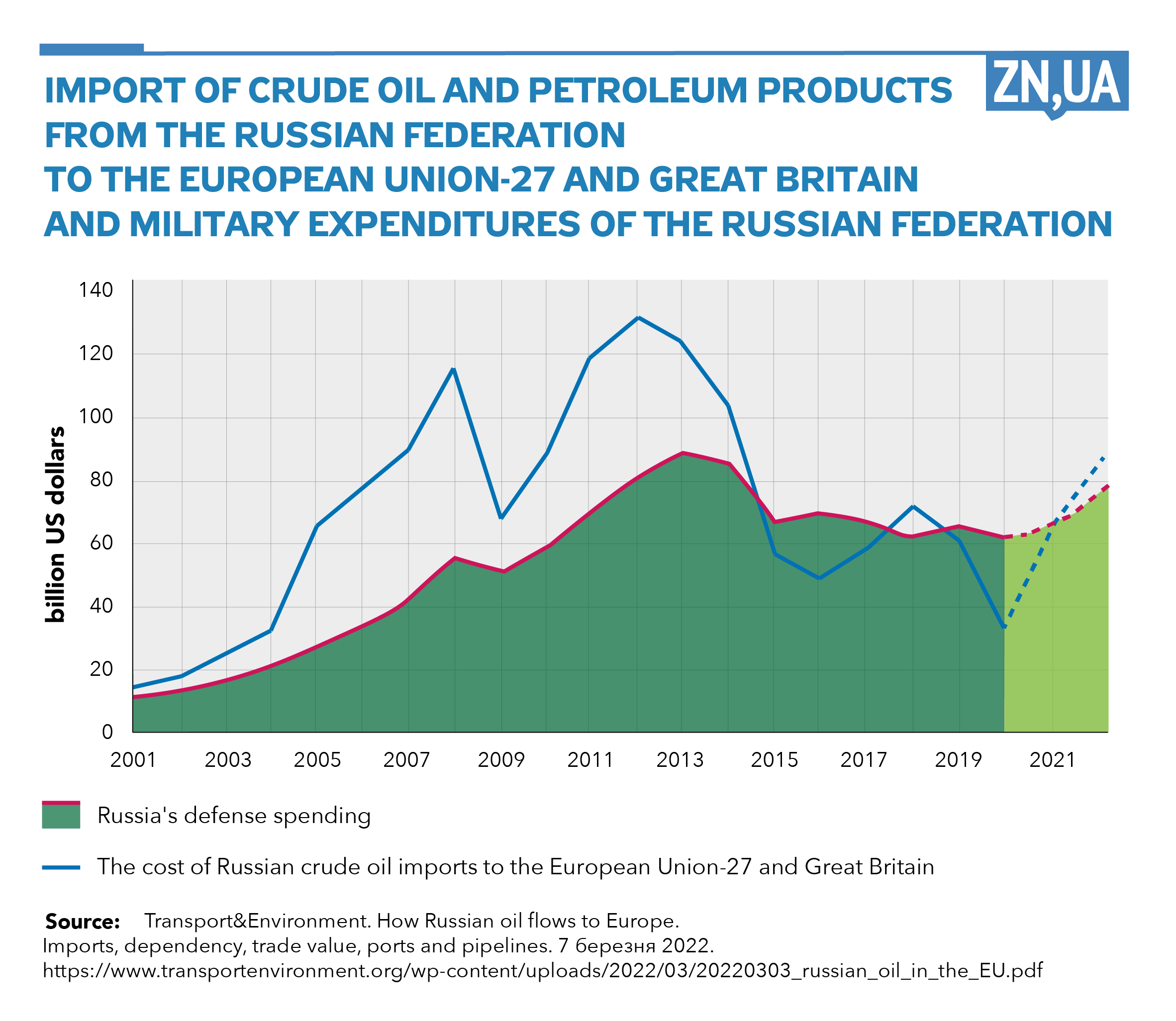

The high import of Russian oil and oil products to Europe in previous years de facto made it a key contributor to the war budget (see figure).

It is worth paying attention to the fact that since 2014, Russia’s military expenditures have been in the range of 60-70 billion dollars per year and did not decrease, despite the drop in the price of oil and the decrease in revenues from its export.

In 2023, Moscow will retain today’s growing dynamics of military expenditures in conditions of sanctions and reduced production and export of energy but at the expense of increased taxation of the oil and gas sector. Over the next three years, the Kremlin wants to take an additional 44 billion dollars from the Russian oil and gas industry for the war due to increased taxation. The logic is simple: the motherland, they say, has given you, oil workers, the opportunity to make good money, and now, you must give it everything it needs to win over the West in Ukraine. Therefore, the super-task for the diplomacy of Ukraine and the group of Central European countries for the year that has begun is to achieve from the West a total economic isolation of Russia.

Please select it with the mouse and press Ctrl+Enter or Submit a bug

Login with Google

Login with Google