State debts and deficits of a warring country

In 2022–2023, the extraordinary conditions of the functioning of the state and the conduct of military operations on the territory of the country were reflected in the indicators of budget expenditures, its deficit, and the state debt. In 2022, the deficit of the state budget of Ukraine was 17.6% of GDP, and in January-April 2023 it was approximately 14.3% of GDP.

Expenditures of the consolidated budget of 2022 in real terms increased by 30.1% compared to 2021. At the same time, the real amount of defense spending increased sevenfold compared to 2021, and spending on public order and security doubled. In the structure of total expenditures, the share of funding for defense, security, and public order increased almost threefold and reached 52.4%.

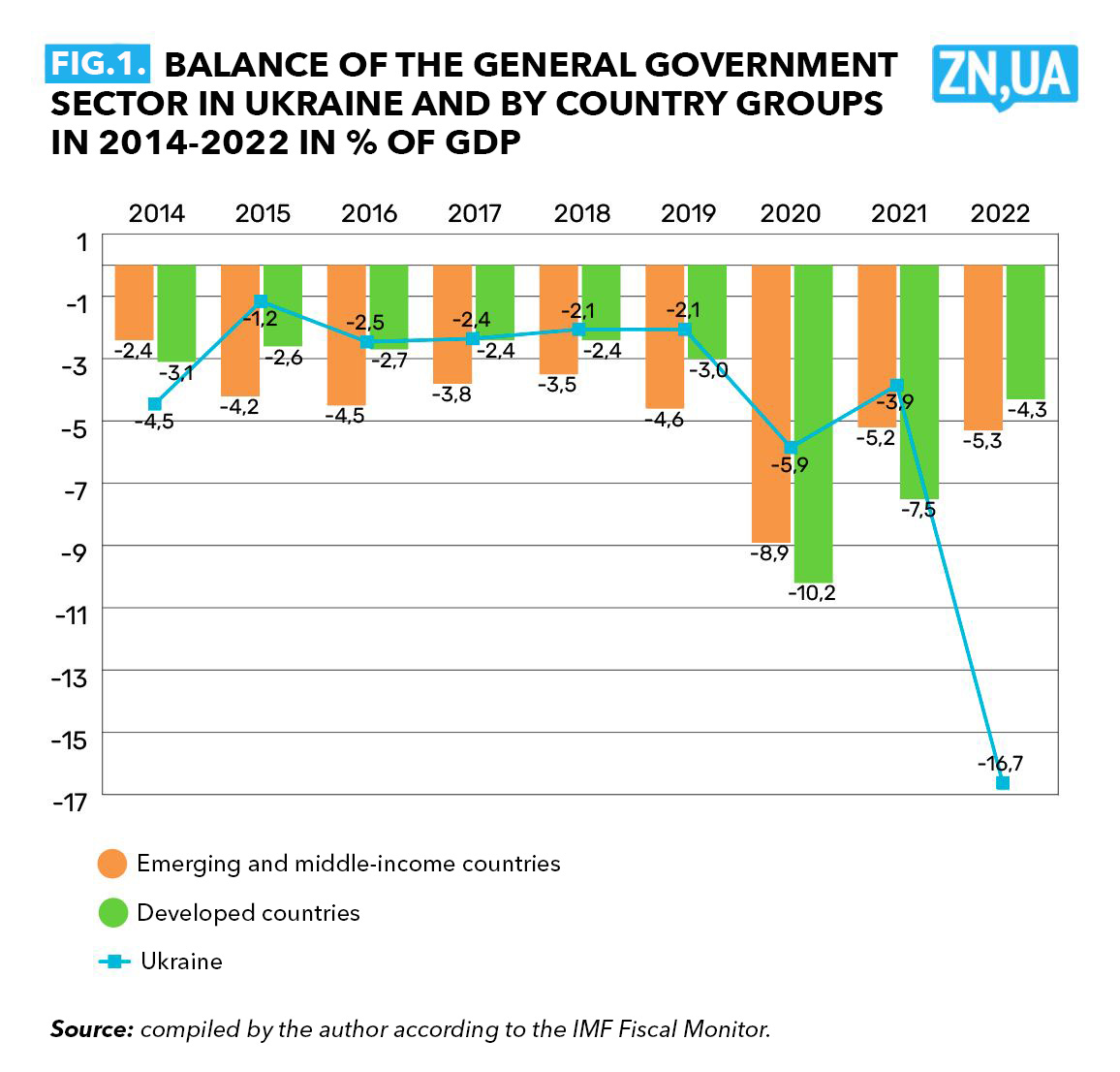

Last year, the deficit of the general public administration sector in Ukraine (16.7% of GDP) many times exceeded the average indicators of developed countries (4.3%) and countries with emerging markets (5.3%). This situation contrasts with previous years, when Ukraine had significantly smaller deficit volumes compared to the average indicators for various groups of countries (see Fig. 1).

From the beginning of Russia's military aggression until the end of 2022, the total volume of financing received by Ukraine from international partners amounted to 31.2 billion US dollars (see Table 1). In 2023, external financing of the budget is expected in the amount of 37 to 41 billion dollars.

As part of budget revenues, grant aid funds from donors amounted to UAH 480 billion in 2022 and UAH 225 billion in January-May 2023. This year, the largest donor of grant support remained the USA (219 billion UAH). Ukraine also received small amounts of grant aid from Germany, Spain, Finland, Ireland, Switzerland, Belgium, and Iceland.

In January-May 2023, UAH 498.6 billion of loan funds were raised from external sources, in particular:

- 7.5 billion euros – EU macro-financial assistance;

- Special Drawing Rights (SDR) 2 billion – extended the International Monetary Fund (IMF) financing loan;

- 2.4 billion Canadian dollars – loans from the Government of Canada;

- 500 million dollars – loans from the International Bank for Reconstruction and Development (IBRD) under the project "Supporting public expenditures to ensure sustainable governance in Ukraine";

- EUR 341.3 million – loans from the International Development Association (IDA).

Table 1. Loan and grant funding of the budget from February 24, 2022 to June 1, 2023.

billion dollars USA

|

Components of financing |

2022 — from February 24 until December 31 |

2023 — from January 1 until June 1 |

|

Domestic loan financing: |

20,2 |

6,7 |

|

1) financing of the National Bank |

12,5 |

0 |

|

2) placement of military bonds |

7,7 |

6,7 |

|

External loan and grant financing |

31,2 |

19,8 |

|

Loans from official multilateral lenders |

12,8 |

11,3 |

|

— The International Monetary Fund (IMF) |

2,7 |

2,7 |

|

— The World Bank |

1,4 |

0,5 |

|

— The European Union (EU) |

8,0 |

8,1 |

|

— The European Investment Bank (EIB) |

0,7 |

0 |

|

Loans and grants from official bilateral creditors |

18,4 |

8,5 |

|

— The USA |

12,0 |

6,0 |

|

— France |

0,4 |

0 |

|

— Canada |

1,9 |

1,8 |

|

— Germany |

1,6 |

0,1 |

|

— The United Kingdom |

1,1 |

0,5 |

|

— Italy |

0,3 |

0 |

|

— The Netherlands |

0,3 |

0 |

|

— Japan |

0,6 |

0 |

|

Total gross loan and grant financing of the budget |

51,3 |

26,5 |

Source: compiled by the author based on data from the Ministry of Finance of Ukraine.

Borrowing made it possible to cover the country's critical needs in the most dramatic period of its existence, but at the same time led to a significant increase in public debt.

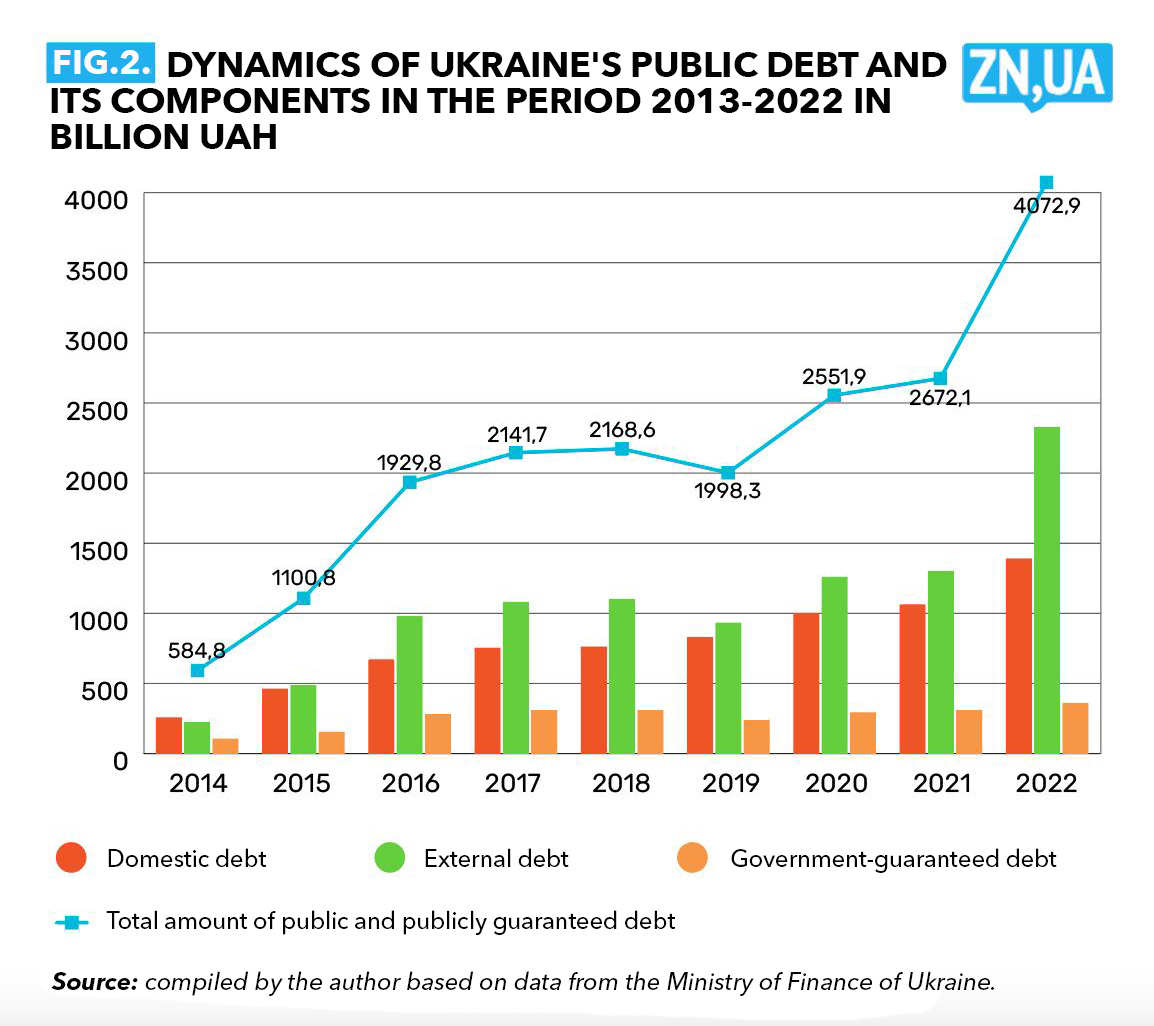

For 2022 and four months of 2023, the total amount of state and guaranteed debt, expressed in hryvnias, increased by UAH 1.9 trillion, or by 70%. In April 2023, the amount of debt reached 4.54 trillion UAH, or 124.3 billion dollars. This amount is equivalent to 87.6% of GDP for 2022.

In 2022, the most significant component of debt growth was direct external debt, which increased by more than UAH 1 trillion, or by 79% (see Fig. 2). At the same time, the volume of direct domestic debt increased by only UAH 0.3 trillion, or by 30.8%.

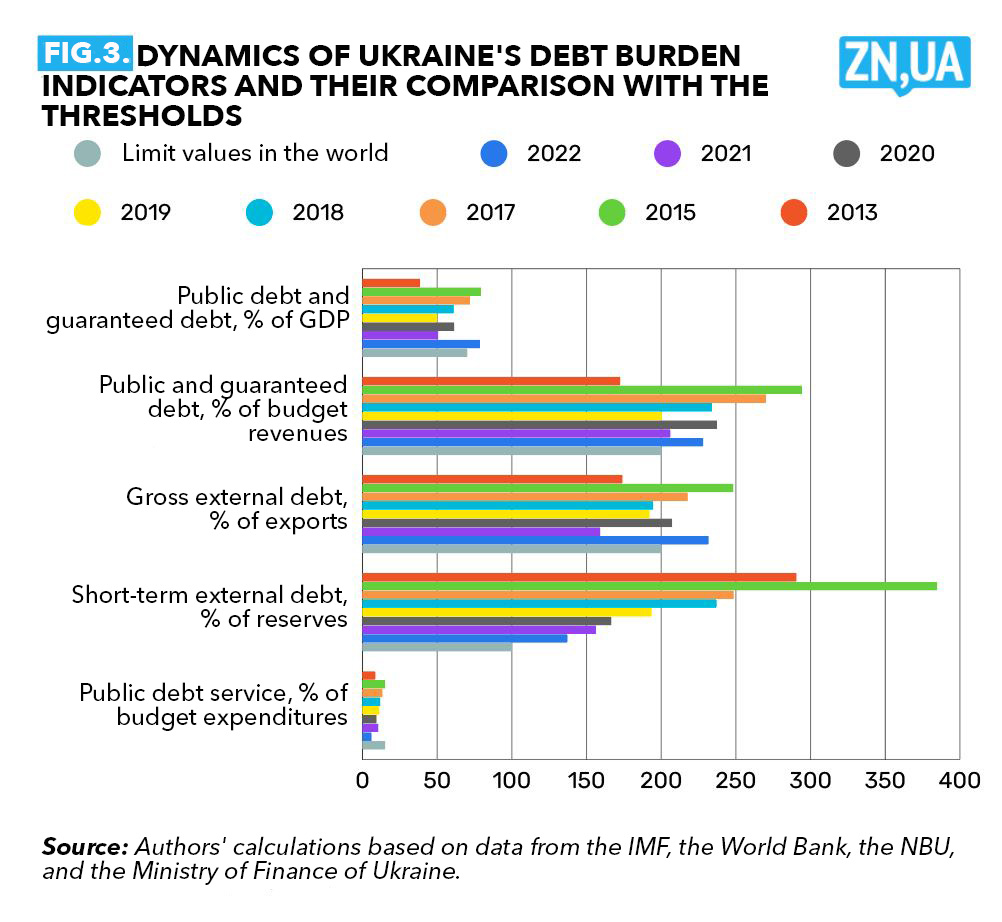

As a result of extraordinary challenges and a drastic reduction in economic activity during the war, the state of Ukraine's debt sustainability inevitably deteriorated. The current level of public debt relative to GDP has already exceeded the threshold for emerging market countries at 70% of GDP (see Fig. 3). In dynamics, the amount of state and guaranteed debt increased from 50.5% of GDP at the end of 2021 to 78.5% in 2022 and to 87.6% of GDP in April 2023.

In relation to budget revenues, state and guaranteed debt increased from 206% in 2021 to 227.9% in 2022, despite the fact that the maximum level of debt according to this indicator is 200%.

The main reasons for the deterioration of Ukraine's debt sustainability were an increase in the budget deficit, a dramatic decrease in GDP, and a significant devaluation of the exchange rate.

However, significant risks for Ukraine's debt sustainability are also caused by the unbalanced structure of the state debt. Thus, in April 2023, the share of debt obligations denominated in hryvnia was only 30.2% of the total debt. Compared to 2021, this share of debt decreased by almost 7 percentage points. This indicates an extremely high level of currency risks of the public debt structure.

Along with external credit financing of the budget, state guarantees were also a notable channel for increasing the state debt during the war. The volume of accumulated state guarantees for loans in April 2023 amounted to UAH 336.6 billion, or $9.2 billion. The amount of new guarantees provided by the government amounted to UAH 47.1 billion in 2022 and UAH 11.9 billion in January-May 2023.

At the same time, the beneficiaries of state guarantees were small and medium-sized business entities for loans on a portfolio basis, “Naftogaz of Ukraine”, “Ukrhydroenergo” PJSC, “Ukrsibban” BNP Paribas Group, “Ukrenergo”, and “Ukrainian Postal Service or Ukrposhta” JSC (see Table 2).

Table 2. State guarantees provided for loans in 2022-2023

|

No. |

The name of the business entity — the recipient of the state guarantee |

Type of guarantee (internal, external) |

Currency of guaranteed credit (loans) |

The amount of the guaranteed loan in hryvnias, million hryvnias |

|

|

2022 year |

|||

|

1 |

Entities of micro-enterprise, small and/or medium-sized enterprise (portfolio guarantee program) |

internal |

UAH |

25 161,2 |

|

2 |

JSC "Ukreximbank" |

external |

USD |

2 925,5 |

|

3 |

PJSC "Ukrhydroenergo" |

external |

USD |

6 172,8 |

|

4 |

JSC "Naftogaz of Ukraine" |

external |

EUR |

10 637,6 |

|

5 |

PJSC "Ukrenergo" |

external |

EUR |

1 262,2 |

|

6 |

JSC "Ukrposhta" |

external |

EUR |

925,3 |

|

|

In total, the loan for 2022 is guaranteed |

|

47 084,6 |

|

|

|

2023 year |

|||

|

1 |

PJSC "Ukrenergo" |

external |

EUR |

11 916,8 |

|

|

Total guaranteed loans for 2023 (January–May) |

11 916,8 |

||

Source: compiled by the author based on data from the Ministry of Finance of Ukraine.

The policy of providing state guarantees became a forced response of the government to deformations of the domestic financial market and the unavailability of credit resources for business. In 2022, the volumes of state guarantees on a portfolio basis increased significantly. Thus, during the year, state guarantees were provided to support small and medium-sized businesses in the amount of UAH 25.2 billion.

At the same time, it should be taken into account that in the conditions of a downturn in economic activity, the risks of non-fulfillment of credit obligations by small businesses increase significantly, which will probably put an additional burden on the state budget in terms of repaying loans to banks.

In order to reduce the fiscal risks of state guarantees, the Memorandum on Economic Policy with the International Monetary Fund (IMF) determined that the government should develop a regulatory framework to strengthen the risk assessment system of state guarantees and establish clear criteria for obtaining them. The memorandum also provides for a permanent performance criterion, namely the upper limit of guaranteed debt growth for 2023 – UAH 37 billion, which corresponds to 3% of the revenues of the general fund of the budget.

These are positive steps, as they will reduce the natural inclination of public authorities to provide large-scale guarantees and encourage them to use alternative available instruments.

However, the following question already arises: why is the National Bank of Ukraine (NBU) discount rate still kept at 25% with annual inflation of 15.3%? After all, the inevitable consequence of the harsh monetary policy is the paralysis of the credit market, which restrains economic activity and puts the responsibility of business lending on the state budget. Today, the country's budget bears the costs of paying interest rates under the "Affordable Credits 5-7-9" program and accepts the risks of repaying business loans under the portfolio guarantee program.

Consequently, the destructive impact of military aggression prompted the Ukrainian state to adopt extraordinary fiscal measures, which rapidly increased budget deficits and the size of Ukraine's public debt. However, such imbalances, obviously, should not be actively implemented at the expense of ill-conceived monetary measures or generous provision of state guarantees.

In addition, efforts should be concentrated on finding adequate sources of financing the budget deficit and the issue of the future restructuring of the external debt should be worked out now. In the process of re-restructuring the government's Eurobond debt, it is necessary to focus on reasonable amounts of discounts to the face value (taking into account secondary market discounts) and avoid issuing surrogate securities with potentially high losses for the budget.

Read this article in russian and Ukrainian.

Please select it with the mouse and press Ctrl+Enter or Submit a bug

Login with Google

Login with Google